michigan sales tax exemption rules

2021 Aviation Fuel Informational Report - - Sales and Use Tax. Tax on sale of food or drink from vending machine.

An additional 400 exemption is available for each disabled veteran in the household.

. Michigan Sales and Use Tax Certificate of Exemption. The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. Michigan Sales and Use Tax Certificate of Exemption.

Sellersare required to maintain records paper or electronic of completed exemption certificates for a period of four years. For example a service whos work includes creating or manufacturing a product is very likely considered to be taxable and thus you would most likely have to pay sales tax on the service. There are no local sales taxes in the state of Michigan.

The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals. According to MCL 20554r. Prepaid Diesel Sales Tax Rate Effective May 1 2022 the new prepaid gasoline sales tax rate is 255 cents per gallon.

T 1 215 814 1743. Tax Exemption Certificate for Donated Motor Vehicle. Exemption is allowed in Michigan on the sale of rolling stock purchased by an interstate motor carrier or for the rental or lease of rolling stock to an interstate motor carrier and used in interstate commerce.

2022 Aviation Fuel Informational Report - - Sales and Use Tax. Michigan Sales and Use Tax Contractor Eligibility Statement. Electronic Funds Transfer EFT Account Update.

In order to be exempt from Michigan sales or use tax certain criteria must be met. Interactive Tax Map Unlimited Use. Michigan Sales and Use Tax Contractor Eligibility Statement.

The purchase or rental must be for University consumption or use and the consideration for these transactions must move from the funds of the. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction. All fields must be.

The state also provides a 2800 special exemption for each tax filer or dependent in the household who is deaf paraplegic quadriplegic hemiplegic totally and permanently disabled or blind. To learn more see a full list of taxable and tax-exempt items in Michigan. All claims are subject to audit.

In the state of Michigan services are not generally considered to be taxable. While most services are exempt from tax there are a few exceptions. The Michigan Department of Treasury recently issued Revenue Administrative Bulletin RAB 2019-15 revising its guidance regarding the application of several new sales and use tax laws to the construction industry.

Non-qualified transactions are subject to tax statutory penalty and interest. However if provided to the purchaser in electronic format a signature is not required. This rate will remain in effect through May 31 2022.

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372. The manufacturer will fill out and send in one form for each of their qualifying vendors. Michigan Compiled Laws Complete Through PA 76 of 2022 House.

Tax Exemption Certificate for Donated Motor Vehicle. This rate will remain in effect through May 31 2022. However orthoses may be exempt from sales and use taxes when dispensed by persons other than orthotists provided the device serves to substitute or replace for a part of the human body and it is purchased on a written prescription or written order issued by a qualified health professional.

Background Over the past several years the Michigan legislature has been active in addressing the Michigan. March 4 2002 LR 2002-2 June Summers Haas. This page describes the taxability of occasional sales in Michigan including motor vehicles.

Adjourned until Tuesday May 24 2022 13000 PM. Sales Tax Return for Special Events. Effective May 1 2022 the new prepaid gasoline sales tax rate is 216 cents per gallon.

Ad Lookup Sales Tax Rates For Free. Sales of vehicles to members of armed forces. Thursday June 10 2021 On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from the states sales and use tax for certain personal.

Sales exempt from tax. No tax is due if you purchase or acquire a vehicle from an immediate family member. Sales Tax Return for Special Events.

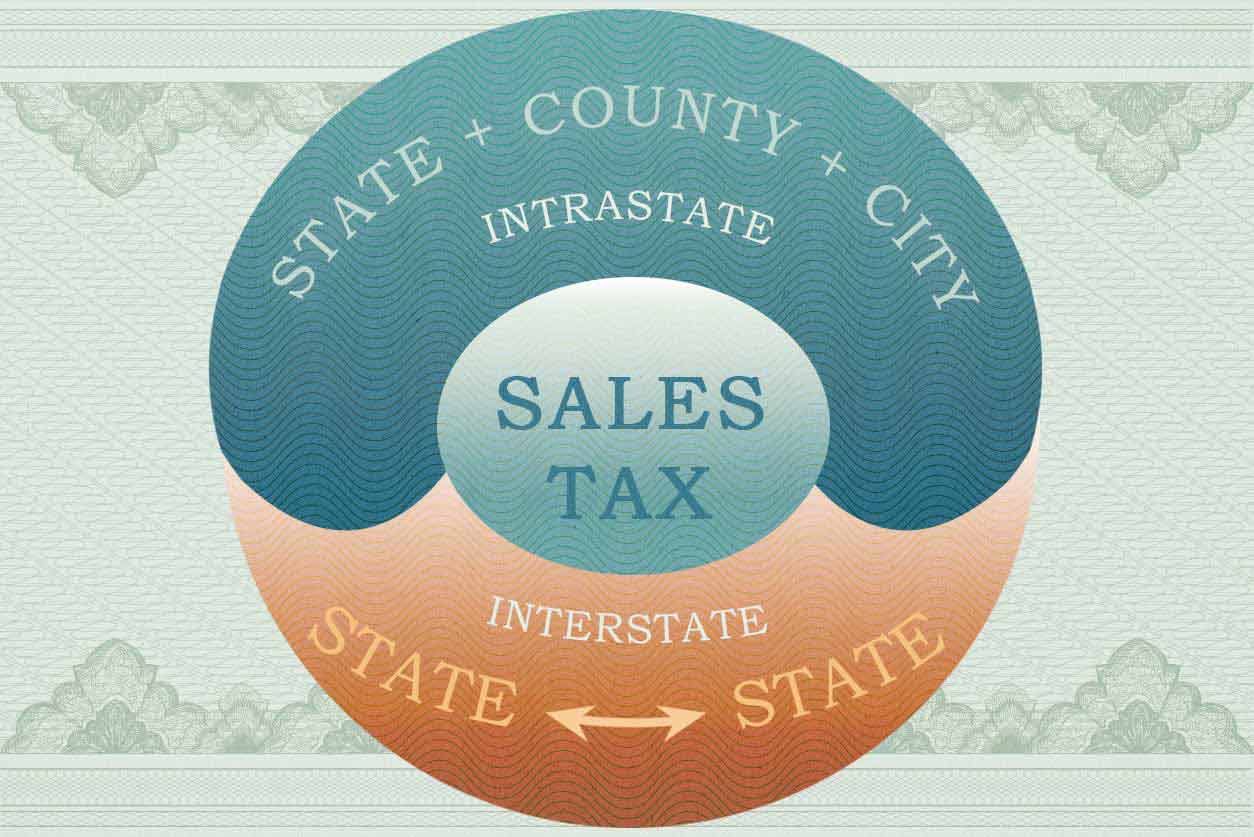

Several examples of exemptions to the states sales tax are vehicles which have been sold to a relative of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery. Examples include government agencies some nonprofit organizations and merchants purchasing goods for resale. Michigan has a statewide sales tax rate of 6 which has been in place since 1933.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. All claims are subject to. Some customers are exempt from paying sales tax under Michigan law.

Use tax is also collected on the consumption use or storage of goods in Michigan if sales tax was not paid on the purchase of the goods. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. 20 rows Sales Tax Exemptions in Michigan.

Electronic Funds Transfer EFT Account Update. This form can be found on the Michigan Department of Treasurys website. Michigan does not issue tax exempt numbers and a seller may not rely on a number for substitution of an exemption certificate.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 6 when combined with the state sales tax.

Michigan manufacturers can easily purchase exempt manufacturing items by supplying their vendors with Michigan Sales and Use Tax Certificate of Exemption Form 3372. While Michigans sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Michigan Sales Tax Small Business Guide Truic

Services Tax Return Filing Consultants Tax Services Tax Preparation Services Accounting Services

Sales Tax By State Is Saas Taxable Taxjar

Which States Require Sales Tax On Clothing Taxjar

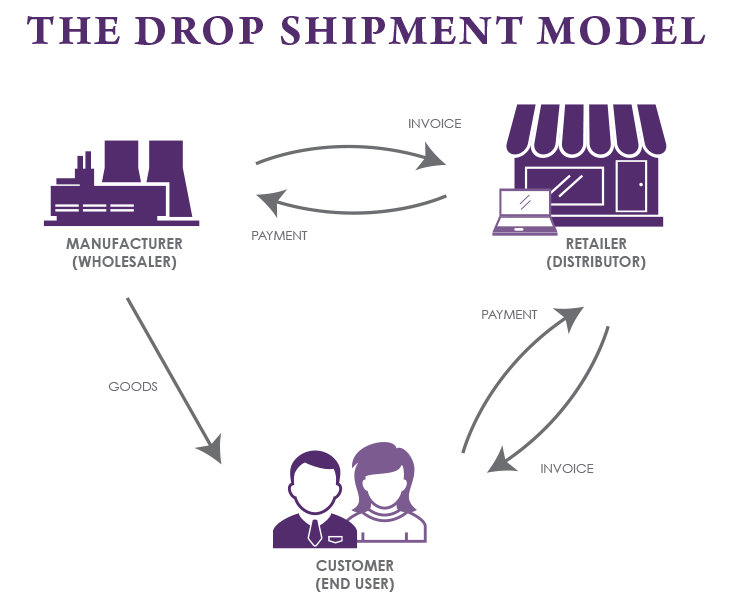

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Sales Tax For Small Businesses Truic

Individuals Use The Option Of Filing An Amendedtaxreturn When He Or She Comes To Know That There Is An Error In His Al Income Tax Tax Consulting Tax Extension

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

What Are Marriage Penalties And Bonuses Tax Policy Center

Michigan Bill Would Allow Expecting Parents To Claim Fetuses As Income Tax Exemptions Tax Preparation Free Workout Routines Tax Deductions

Requirements For Tax Exemption Tax Exempt Organizations

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)